Georgia, a country in east Europe, is becoming increasingly appealing for software development outsourcing around the world. International companies such as Epam Systems, DataArt, Godel Technologies, and others have already entered the market and are expanding day by day. Aside from that, many foreign companies are establishing branches in Tbilisi or retaining Georgian IT professionals on a remote basis. In the first quarter of 2023, the Georgian IT sector generated a revenue of 231 million USD, which is much higher compared to the previous year, referring to the stable growth of this sector.

Below is provided brief info about the key benefits Georgia proposes to the international market that clears up the reason of the Georgian IT market’s emerging popularity.

Table of Contents

International Company Status – Tax “Heaven” for IT Companies

Companies that successfully go through certain legal procedures and obtain International Company Status (ICS) in Georgia, enjoy a long list of unique tax benefits, some of which are briefly reviewed below.

- Personal Income Tax (PIT) – Companies with ICS are paying only 5% flat (non-progressive) PIT, which is arguably the best rate in Europe and one of the best in the whole world. For comparison, the average PIT rate in the EU zone is said to be as high as 37.8%. The PIT rate is particularly important for the cost-effectiveness of a service provider company’s business because a higher PIT means a higher salary cost for the company. As a result, applying 5% PIT to any type of IT service provider company significantly increases business cost-effectiveness.

- Corporate Income Tax (CIT) – Georgian tax legislation is adapted to the so-called “Estonian” model, which essentially means that the company pays 0% CIT on reinvested and retained earnings and CIT is only payable when the company distributes the profit to the shareholders. For the companies with ICS, distributed profits are taxed at only 5% flat (non-progressive) CIT rate. For comparison, the average CIT rate in the European zone is said to be as high as 21.7%. Furthermore, ICS Companies may distribute profits completely tax-free in the amount of salaries paid to Georgian citizens who are also residents of Georgia. As a result, in some cases, the effective CIT rate can be reduced to 0%.

- Dividend Tax – Companies with ICS are paying 0% dividend tax.

- Value Added Tax (VAT) – the VAT rate in Georgia is 18%, however, some types of transactions are exempt from VAT in certain circumstances. Most of the transactions of typical ICS companies are fully exempt from VAT.

- Property Tax – Companies with ICS are exempt from property tax in Georgia (except for land and property not related to the relevant activity of the company).

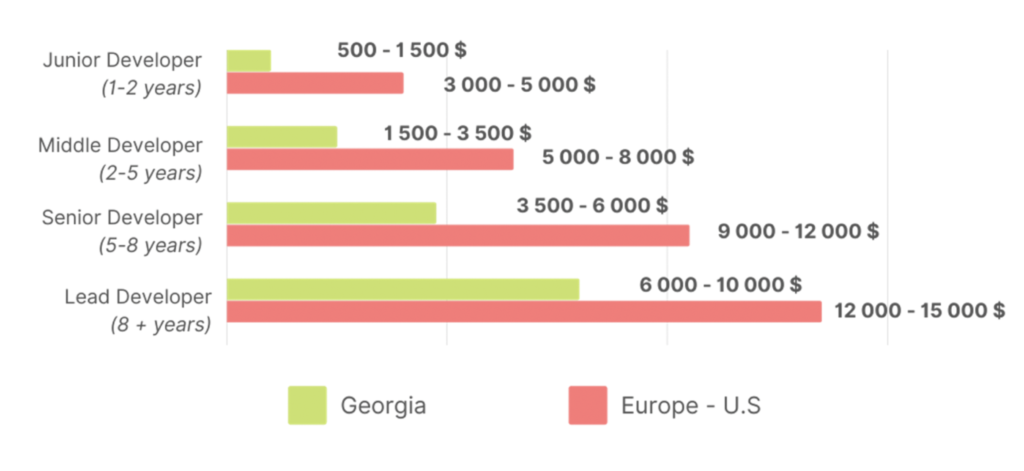

Quality Talent Pool and Competitive Market Salaries

Georgia is full of highly qualified IT professionals, including software developers, UI/UX designers, software project managers, etc., Most of the Georgian based professionals fluently work in English and provide an excellent service. Aside from qualification, the Georgian talent pool is extremely appealing due to competitive market salaries. The following table roughly illustrates the mentioned comparative monthly salary advantage:

The most popular programming languages in Georgia are the following: JavaScript, Java, C++, React, PHP, CSS, HTML, Redux, Python, Angular, and others.

Other Factors of Macroeconomics

Georgian market is also attractive for general factors of macroeconomics, including, low living costs, leading world rank for ease of starting/doing business, convenient time zone (GMT +4), leading world rank for country safety, no significant cultural gaps with foreign countries, low utilities, highly developed digital products (banking, public services, etc.,), and liberal migration rules. Currently, the European Union is officially examining the issue related to granting EU Membership Candidate Status to Georgia, which will further accelerate the tempo of the development of this market.

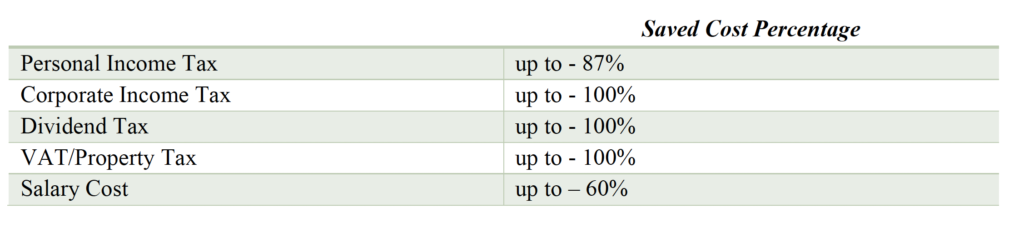

Conclusive Table of Proposed Benefits

Based on the information provided above, the illustrative table below roughly shows how much a foreign IT company can save by entering the Georgian market.

The Impact of Consultive: How We Can Help

Given the mentioned benefits and the ongoing rapid development of Georgia’s emerging IT market, many believe that it has the potential to soon become another major software powerhouse in the world. Hence, we believe that now is an excellent time for IT companies to discuss the possibility of entering the Georgian market. Consultive offers to render the complete package of comprehensive services, necessary for setting up a fully operational business branch in Georgia, as well as various types of partnership opportunities. The business setup package includes but is not limited to the following: pre-investment consulting, corporate structure formation, company/branch incorporation, bank account opening, tax account opening, representation before the governmental bodies for obtaining International Company Status, trademark registration, office selection, recruitment, management/partnership services and any type of legal service that may be required during the course of the process.

Comments are closed.